In the fast-paced world of finance, where fortunes can be won or lost in the blink of an eye, there’s a trading technique that few know about: Algorithmic Trading.

Traders equipped with cutting-edge technology leverage intricate mathematical models and artificial intelligence and execute trades with pinpoint accuracy. All while sifting through mountains of data in real time. Meanwhile, traditional traders are left in the dust, struggling to keep up with the lightning-fast pace of the market.

In this blog, we explain algorithmic trading, how it works, and the skills you’ll need to use it.

What is Algo Trading?

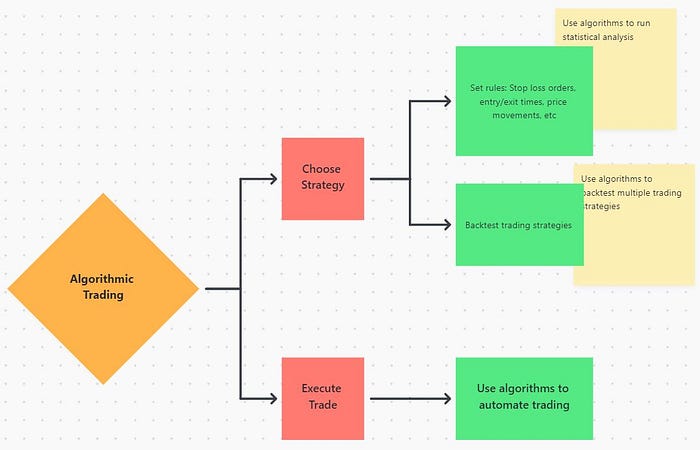

Algorithmic trading is a method by which a trade is executed by a computer program (an algorithm) when a predefined set of conditions is met. The basic idea is that you can create algorithms to execute trades automatically when the trading conditions match the rules you’ve defined in a strategy. Like the exit and entry times, stop loss orders, and price movements.

Trades can be executed in a matter of seconds. Therefore, the trader enjoys economies of scale by making decisions to buy or sell way faster than a person deploying strategies manually.

The use cases for algorithmic trading go above and beyond deploying a trade. You can use it for

- For decision-making (Conducting technical analysis, charting, market scanning, automatic trend detection, tick & volume analysis, getting market alerts)

- Conducting backtesting (Running simulations to test your algorithms effectiveness in different indexes)

- Order execution (Buy or sell trades when predefined conditions are met)

- Execute trading strategies like arbitrage and trend trading.

Benefits of Algo Trading

Processes vast amounts of data — Algorithms can process vast amounts of data and make trading decisions in a matter of milliseconds. Allowing for quick reactions to market changes and the exploitation of short-term price movements. This speed advantage is particularly important in highly liquid markets where prices can change rapidly.

Truly rational decision-making — Another benefit of algorithmic trading is its ability to remove human emotions and biases from the trading process. Emotions such as fear and greed can often cloud judgment and lead to irrational trading decisions. If you rely on pre-programmed rules and algorithms, the emotional component is removed from the trading process.

How Does Algo Trading Work?

Algo trading uses mathematical models and statistical analysis combined with the power of AI and ML to execute trades that are more likely to yield favorable outcomes.

In order to understand how algo trading works, we must first look at its evolution.

- Our bias stops us from succeeding: Here’s a simplified version of the trading process. First, you do a fundamental analysis of companies to finalize a trading strategy. Rely on gut feeling after the analysis, then decide to place the order, then execute it. In reality, people don’t always act completely rationally in the financial market. That’s because of a very human nature. We’re made up of our biases and judgments of the world. So, humans are more prone to misinterpretations when making decisions, even after doing the fundamental analysis.

- Let math lead the way: Systematic traders use quantitative models and historical data to identify trends in the market that they can capitalize on. They perform calculations manually based on charts and analysis, which takes a considerably longer time, but it gave rise to the era of high-frequency trading, which investment companies often used to do to gain a competitive edge in the market.

- Backtesting trading strategies takes time: Not only did they take incredible time to calculate probabilities, but they also needed to backtest these strategies to learn how effective they were on the markets, which again takes time.

- Introducing AI- and ML-powered quantitative trading: Now, these calculations take a lot of time and computing power. Developers created codes to execute these calculations within seconds. Algorithms can automate both the processes of quant analysis and running backtests.

Common Aglo Trading Strategies Used:

Some common strategies you can use in algo trading include trend following, mean reversion, statistical arbitrage, and market making.

- Trend-following algorithms aim to identify and capitalize on long-term market trends. Whereas mean reversion algorithms look for opportunities to profit from the reversal of short-term price movements.

- Statistical arbitrage algorithms seek to exploit pricing inefficiencies between related financial instruments. Whereas market-making algorithms provide liquidity by continuously buying and selling securities.

These are just a few examples of the many strategies that can be employed in algorithmic trading. Traders and fund managers can choose the strategies that best suit their investment goals and risk tolerance.

Once the trading signals are generated, the algorithms automatically execute trades by sending orders to the market. This is typically done through electronic trading platforms or direct market access (DMA) systems.

Here’s a step-by-step guide on starting algorithmic trading as a beginner.

Which language is used in algo trading?

Some widely used languages to create trading algorithms include

- Python, (easy to learn, access helpful libraries, and strong community)

- Java, (platform independence, allows algorithms to run on various systems without modification)

- C++, (high-performance capabilities, enabling low-latency execution crucial in high-frequency trading environments)

- R. Python (extensive library ecosystem and readability)

How to do Algorithmic Trading?

Algorithmic Trading can be done by using API provided by bleeding-edge software companies like Creed&Bear on online trading applications. It depends on what kind of user you are.

Algo trading is mostly used by institutional investors or large brokerage firms who are looking to capitalize on minute changes in prices. Research suggests that algorithmic trading is found to be a cost-effective technique. But it applies only to order sizes that are up to 10% of the average daily trading volume.

For such traders, APIs are more suitable since they can be personalized to your particular needs. However, if you’re an individual trader, you could go for electronic trading platforms that offer algo trading programs.

Top skills needed for algo trading?

There are several key skills that are essential for success in algorithmic trading. Depending on whether you’re trading to fuel your own interests or you’re part of larger fund management companies, the skill requirements may vary.

Here are some basic skills needed for algo trading:

- Quantitative analysis: Algorithmic trading relies heavily on data analysis and mathematical modeling. Traders need to be able to analyze large datasets, identify patterns, and develop mathematical models that can predict market movements. Strong analytical and mathematical skills are therefore essential.

- Econometrics: The study of econometrics allows you to analyze and model complex financial data. It combines economic theory, statistical analysis, and mathematical modeling to understand and predict economic phenomena. This could be really useful when understanding the relationship between different variables in the financial markets. Trading models developed through econometrics enable you to quantify the impact of various factors on asset prices. Like interest rates, inflation, or market sentiment. It also helps you assess the risk and return of your trading strategies–like estimating the volatility and correlation of different assets, which are crucial for portfolio management.

- Risk management: Algorithmic trading involves executing a large number of trades at high speeds, which can increase the risk of financial losses. Traders need to have a thorough understanding of risk management techniques and be able to implement effective risk mitigation strategies to protect their investments.

- Knowing programming languages: One of the most important skills is a strong understanding of coding. Algorithmic trading involves developing and implementing complex trading strategies using computer programs, so having a solid foundation in programming languages such as Python, C++, or Java is crucial.

In short

Algo trading may seem like a lot. But in reality, it’s a simple concept if you understand trading already. As we wrap up our learnings, it’s important to remember that algorithmic trading isn’t a magic bullet but rather a sophisticated tool that requires careful planning, adaptability, and a lot of unlearning and relearning. It’s a field where innovation never rests, and staying on top of the latest developments is key to thriving in this dynamic environment. With the mushrooming of AI and ML, coders today can leverage the power of deep learning to reiterate their algorithms to get more favorable outcomes.

Find out how Creed&Bear can help you with unique algorithmic trading software here.

AI Usage: This article was initially drafted with the assistance of artificial intelligence and subsequently edited to ensure originality and avoid plagiarism. However, in the event that the content inadvertently resembles other works, we do not assume responsibility for any unintentional overlaps or similarities. We invite readers to notify us of any such resemblances so that we can make the necessary modifications in respect and consideration of other authors and brands.

Finance and Trading: The insights and opinions expressed in this blog post concerning trading and market are solely those of the author and should not be interpreted as financial advice. This content is for informational purposes only and does not constitute recommendations or endorsements for any specific investments, securities, or financial strategies. Readers should conduct their own research or consult with a financial professional before making any investment decisions.